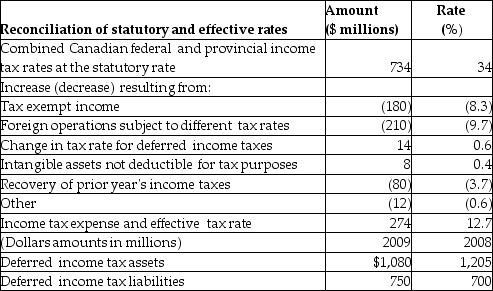

For the year ended October 31,2018,NB Financial Group (National Bank)reported income before tax of $2,160 million and income tax expense of $274 million,for an effective tax rate of 12.7% ($274m / $2,160m).In the notes to the financial statements,NB's disclosures included the following information:

Required:

Required:

a.From NB's disclosures provided above,identify any permanent differences.

b.In which direction did the tax rate change from 2017 to 2018?

c.Refer to the line "Recovery of prior years' income taxes" in the above disclosures.What does this information imply about NB's treatment of tax losses in prior years?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: A company has a deferred tax liability

Q65: State whether or not discounting of deferred

Q68: In the first two years of operations,

Q70: In the first two years of operations,

Q73: In the first year of operations, a

Q75: Summarize the IFRS rules for presentation and

Q98: A company had taxable income of $2

Q100: Elle,Kay and Jay Inc.has a deferred tax

Q104: During its first year of operations,Keen Corp.reported

Q107: In the first two years of operations,a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents