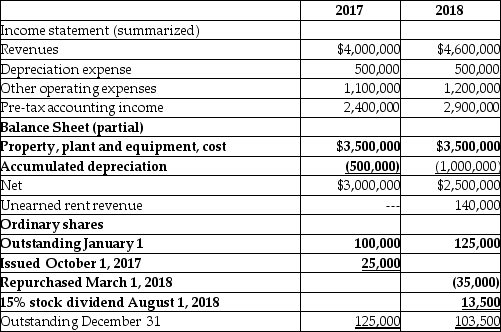

ZEA Company started operations in 2017.The financial statements of ZEA reflected the following pre-tax amounts for its December 31 year-end:

ZEA has a tax rate of 30% in 2017 and 35% in 2018,enacted in February each year.The unearned rent revenue represents cash received from a tenant that will be moving into the building February 15,2019.For tax purposes,any cash received for future rent is taxed when the cash is received.On July 1,2018 the company was fined $20,000 (included in other operating expenses)for violating a building code,this fine is not tax deductible.ZEA claimed CCA for tax purposes of $600,000 in 2017 and $700,000 in 2018.

ZEA has a tax rate of 30% in 2017 and 35% in 2018,enacted in February each year.The unearned rent revenue represents cash received from a tenant that will be moving into the building February 15,2019.For tax purposes,any cash received for future rent is taxed when the cash is received.On July 1,2018 the company was fined $20,000 (included in other operating expenses)for violating a building code,this fine is not tax deductible.ZEA claimed CCA for tax purposes of $600,000 in 2017 and $700,000 in 2018.

Required:

a.Calculate the income tax expense for 2017 and 2018.

b.Calculate the weighted average number of ordinary shares outstanding in each of 2017,and 2018.

c.Calculate the basic EPS for each of 2017,and 2018.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: State whether or not discounting of deferred

Q69: A large public company reported that its

Q71: In its first year of operations, a

Q76: In the first year of operations, a

Q77: In the first two years of operations,

Q107: In the first two years of operations,a

Q109: Summarize the rules covering presentation and disclosure

Q111: Under ASPE,Section 3465 indicates less onerous disclosures

Q114: During its first year of operations,Karol Corp.reported

Q117: Using the following table,contrast the substantive differences

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents