Cardiff Corporation is a public company traded on a major exchange.Cardiff's common shares are currently trading at $21 per share.The board of directors is debating whether to issue a 200% stock dividend or accomplish a similar result by doing a stock split.The board is wondering how shareholders' equity would be affected,and whether the value of the typical shareholder's investment will change.

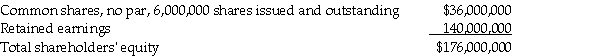

Details of Cardiff's equity section of the balance sheet are as follows:

Required:

Required:

a.At what price would you expect the shares to trade after either transaction? Explain with calculations.

b.Show what the equity section of the balance sheet for Cardiff would look like after the stock dividend or stock split.

c.Assume that an investor has 6,000 common shares before the stock dividend or stock split.What would be the value of the investor's holdings before and after the stock dividend or stock split?

d.What is your recommendation to the board of directors?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Contrast the different treatment between IFRS and

Q46: What needs to be reconciled in each

Q49: Which of the following statements is correct?

A)Only

Q51: IAS 1, Presentation of Financial Statements, stipulates

Q52: Which statement is correct regarding dividend entitlement?

A)Cumulative

Q74: Which statement about "stock dividends" is correct?

A)Only

Q88: Use the following facts to determine how

Q91: List the five classes of transactions that

Q95: Summarize the difference between IFRS and ASPE

Q96: Nala Company has two classes of shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents