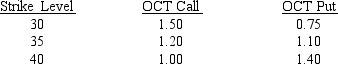

Use the following information on CBOE 13-week T-bill rate options to answer the following question(s) .

-Refer to CBOE.Suppose you want to cap your interest rate before a planned October borrowing.What is the cost of using the OCT 35 option to hedge?

A) $110 per contract

B) $1.10 per contract

C) $120 per contract

D) $1.20 per contract

Correct Answer:

Verified

Q10: Use the following information on CBOE 13-week

Q11: Suppose the spot exchange rate is 0.5491

Q12: Use the following information on CBOE 13-week

Q13: You are a financial manager with ICN,Co.and

Q14: Which of the following is NOT a

Q16: The Exim Company has entered into a

Q17: The Exim Company has entered into a

Q18: The MakeStuff Company's earnings stream is highly

Q19: Suppose rising gas prices cut into consumer

Q20: The MakeStuff Company's earnings stream is highly

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents