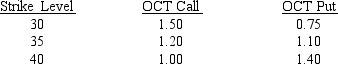

Use the following information on CBOE 13-week T-bill rate options to answer the following question(s) .

-Refer to CBOE.If you used the OCT 35 option to hedge rising rates,and the yield to maturity (YTM) on 13-week bills is 3.75 percent at the option's expiration,what is the outcome of your hedge?

A) profit of $250 per contract

B) profit of $130 per contract

C) loss of $120 per contract

D) no gain or loss, the option expires worthless

Correct Answer:

Verified

Q7: Which of the following is a (are)key

Q8: Why might a financial manager prefer using

Q9: The MakeStuff Company's earnings stream is highly

Q10: Use the following information on CBOE 13-week

Q11: Suppose the spot exchange rate is 0.5491

Q13: You are a financial manager with ICN,Co.and

Q14: Which of the following is NOT a

Q15: Use the following information on CBOE 13-week

Q16: The Exim Company has entered into a

Q17: The Exim Company has entered into a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents