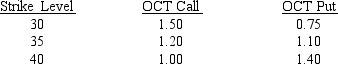

Use the following information on CBOE 13-week T-bill rate options to answer the following question(s) .

-Refer to CBOE.Suppose you want to construct a collar to reduce the cost of the cap by selling a floor.What is the net cost of the least expensive such collar? (Be sure the strike prices on the call and the put are NOT the same!)

A) $0.10 per contract outflow

B) $10 per contract outflow

C) $0.10 per contract inflow

D) $10 per contract inflow

Correct Answer:

Verified

Q5: A standard "fixed for floating" interest rate

Q6: The spot rate on the British pound

Q7: Which of the following is a (are)key

Q8: Why might a financial manager prefer using

Q9: The MakeStuff Company's earnings stream is highly

Q11: Suppose the spot exchange rate is 0.5491

Q12: Use the following information on CBOE 13-week

Q13: You are a financial manager with ICN,Co.and

Q14: Which of the following is NOT a

Q15: Use the following information on CBOE 13-week

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents