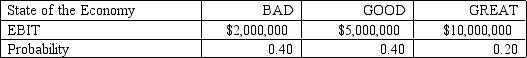

ABC Corporation has a capital structure that consists of $20 million in debt and $40 million in equity. The debt has a coupon rate of 10%, while the industry return on equity is 15%. ABC Corporation is unsure of the state of the economy in the next year. The tax rate facing the company is 40%.

-Refer to ABC Corporation.The company is considering the issue of $10 million in new debt at a rate of 10%.The funds from the new debt will be used to retire $10 million in equity.Currently,there are 1 million shares outstanding trading at $40 per share.Assuming the stock price will remain the same,what is the expected earnings per share in the next year if the company goes through with the re-capitalization?

A) $1.32

B) $1.56

C) $1.68

D) $1.76

Correct Answer:

Verified

Q56: The Globe Incorporated has EBIT of $20

Q57: Costs associated with the requirement that management

Q58: Which statement is TRUE regarding a firm

Q59: Firm Y issued $100,000,000 of bonds last

Q60: The Globe Incorporated has EBIT of $30

Q62: Financial distress can be particularly dangerous to

Q63: Burdell Scientific Incorporated finances its operations with

Q64: Which statement correctly describes proposition I of

Q65: ABC Corporation has a capital structure that

Q66: Oak Barrel Company has net operating income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents