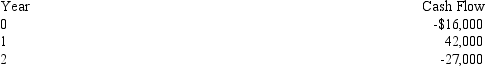

Consider a project with the following cash flows.

What's the IRR of the project? If a firm's cost of capital is 15%,should the firm accept the project?

A) 50%; accept the project

B) 12.5%; reject the project

C) 12.5% and 50%; accept the project

D) 12.5%, and 50%; reject the project

Correct Answer:

Verified

Q2: Kelley Industries has 100 million shares of

Q3: The capital budgeting process involves

A) identifying potential

Q4: Future Semiconductors is evaluating a new etching

Q5: Exhibit 8-1

The cash flows associated with an

Q6: A firm has 10 million shares outstanding

Q8: Exhibit 8-2

A piece of equipment costs $1.2m.

Q9: Gamma Electronics

Gamma Electronics is considering the purchase

Q10: Gamma Electronics

Gamma Electronics is considering the purchase

Q11: Gamma Electronics

Gamma Electronics is considering the purchase

Q12: Exhibit 8-2

A piece of equipment costs $1.2m.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents