Thompson Manufacturing Thompson Manufacturing Is Considering Two Investment Proposals. the First Involves

Thompson Manufacturing

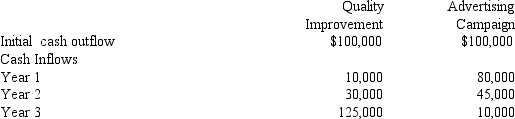

Thompson Manufacturing is considering two investment proposals. The first involves a quality improvement project, and the second is about an advertising campaign. The cash flows associated with each project appear below.

-Refer to Tompson Manufacturing.Suppose the hurdle rate of the firm is 10%.Calculate the cash flows of the "incremental project" by subtracting the cash flows of the second project from the cash flows of the first project.What is the IRR of the incremental project?

A) 20.7%

B) 23.1%

C) 17.9%

D) 10.0%

Correct Answer:

Verified

Q32: NPV Profile

The figure below shows the NPV

Q33: A project may have multiple IRRs when

A)

Q34: NPV Profile

The figure below shows the NPV

Q35: Potential problems in using the IRR as

Q36: An entrepreneur is offered a service contract

Q38: Kelley Industries is evaluating two investment proposals.The

Q39: Exhibit 8-3

A firm is evaluating two investment

Q40: The following information is given on three

Q41: NPV Profile

The figure below shows the NPV

Q42: The compound annual return on a project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents