Thompson Manufacturing Thompson Manufacturing Is Considering Two Investment Proposals. the First Involves

Thompson Manufacturing

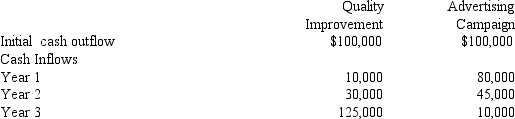

Thompson Manufacturing is considering two investment proposals. The first involves a quality improvement project, and the second is about an advertising campaign. The cash flows associated with each project appear below.

-Refer to Tompson Manufacturing.Suppose the hurdle rate of the firm is 10%.If the two projects are mutually exclusive,which project should be chosen? What is the problem that the firm should be concerned with in making this decision?

A) Quality improvement project; project scales

B) Advertising campaign; project scales

C) Quality improvement project; the timing of cash flows

D) Advertising campaign; the timing of cash flows

E) Advertising campaign; discount rate

Correct Answer:

Verified

Q17: Delta Pharmaceuticals has 200 million shares outstanding

Q18: The preferred technique for evaluating most capital

Q19: Exhibit 8-1

The cash flows associated with an

Q20: Should a firm invest in projects with

Q21: Consider a project with the following stream

Q23: You are provided with the following data

Q24: NPV Profile

The figure below shows the NPV

Q25: You must know the discount rate of

Q26: NPV Profile

The figure below shows the NPV

Q27: Exhibit 8-3

A firm is evaluating two investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents