Normaltown Corporation

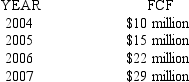

An analyst has predicted the free cash flows for Normaltown Corporation for the next four years:

-After 2007,the free cash flows are expected to grow at an annual rate of 5%.The weighted average cost of capital for Normaltown is 12%.If the market value of the firm's debt is $100 million,find the value of the firm's equity.

A) $201.81 million

B) $213.00 million

C) $231.43 million

D) $271.20 million

Correct Answer:

Verified

Q75: Which is NOT a feature of common

Q76: Stone Cold Incorporated reported net income of

Q77: What is the largest (trading volume)over-the-counter (OTC)market

Q78: A stock is expected to pay a

Q79: For a stock pricing model,an analyst selects

Q81: A Green Shoe option is:

A) the option

Q82: Zuma Corporation just paid a dividend of

Q83: When evaluating the secondary market based upon

Q84: Ajax Corporation just paid a dividend of

Q85: Which of the following statements is false?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents