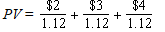

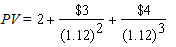

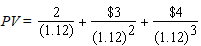

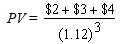

Suppose a professional sports team convinces a former player to come out of retirement and play for three seasons.They offer the player $2 million in year 1,$3 million in year 2,and $4 million in year 3.Assuming end of year payments of the salary,how would we find the value of his contract today if the player has a discount rate of 12%?

A)

B)

C)

D)

Correct Answer:

Verified

Q58: Which of the following should have the

Q59: Uncle Fester puts $50,000 into a bank

Q60: A young couple buys their dream house.After

Q61: A bank is offering a new savings

Q62: A $100 investment yields $112.55 in one

Q64: As a young graduate,you have plans on

Q65: Cozmo Costanza just took out a $24,000

Q66: What is the future value of a

Q67: In five years,you plan on starting graduate

Q68: Suppose that Hoosier Farms offers an investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents