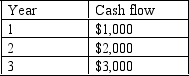

Consider the following cash flows each arriving at the end of the year.If the discount rate is 15% ,what is the (3-year) EQUIVALENT ANNUITY ?

A) $1,935.65

B) $1,932.48

C) $1,916.62

D) $1,907.13

Correct Answer:

Verified

Q135: You are comparing four different investments,as described

Q136: You invest $10,000 in August 2004.In August

Q137: If you were evaluating a investment over

Q138: Which of the following statements is TRUE?

A)

Q139: You wish to save $2,500,000 for your

Q140: An annuity is considered:

A) an ordinary annuity

Q141: Roxy is buying a house and the

Q143: Roxy is buying a house and the

Q144: Consider the following cash flows each arriving

Q145: Consider the following cash flows each arriving

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents