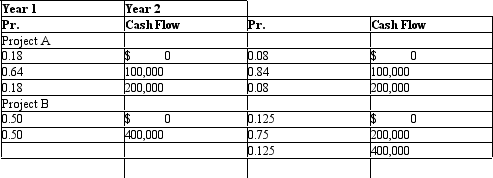

Expected Return. Pediatric Medicine, Ltd., is considering two alternative capital budgeting projects. Project A is an investment of $300,000 to renovate office facilities. Project B is an investment of $600,000 to expand diagnostic capabilities. Relevant cash flow data for the two projects over their expected two-year lives are as follows:

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

B. Calculate the risk-adjusted NPV for each project, using a 12% cost of capital for the more risky project and 10% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: If the tax rate is 25% and

Q18: An estimate of the firm's cost of

Q19: The most difficult step in capital expenditure

Q20: Acceptance of new investment projects will increase

Q21: NPV Analysis. Paralegal Services, Inc., is contemplating

Q23: NPV Analysis. The Health Maintenance Organization, Ltd.,

Q24: The beta coefficient is:

A) a relative measure

Q25: Expected Return. Dr. Kevin Lenahan & Associates

Q26: NPV Analysis. The Santa Catalina Passenger Ferry

Q27: NPV Analysis. The net present value (NPV),

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents