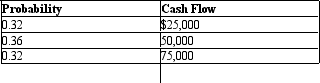

Probability Analysis. The Seattle HMO, Inc. is considering entering into a data processing contract with a leading consulting firm. Entering into such an agreement would require a current investment outlay of $200,000. The following net cash flows (cost savings) will be generated each year over the ten-year life of the management contract:

A. Calculate the expected cash flow.

A. Calculate the expected cash flow.

B. Calculate the standard deviation and coefficient of variation of cash flows (risk).

C. Calculate the expected net present value for the investment if the firm uses a discount rate of 20%. Should the investment be undertaken?

Correct Answer:

Verified

Q30: Certainty Equivalent Method. Saddie Hawkins, a management

Q31: Probability Analysis. Tex-Mex, Inc. is a rapidly

Q32: Certainty Equivalents. Rabbit Food, Inc., is a

Q33: Expected Return Analysis. Alex P. Keaton has

Q34: Probability Analysis. Ceramic Tile, Inc. wishes to

Q36: Decision Trees. Atlanta Corporation has been supplying

Q37: When E(R) = $100,000, only a risk-seeking

Q38: Certainty Equivalents. Pier-4, Inc. is a rapidly

Q39: Expected Return Analysis. Dr. John Carter offers

Q40: When the dispersion of possible returns is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents