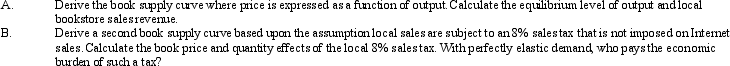

Sales Tax and Elastic Demand. Assume that the supply of a best-selling book at local book stores throughout the United States is a function price such that:

where Q is the number of books sold (in thousands) and P is the book price. Given the availability of this book on amazon.com for $20, demand is perfectly elastic at a price of $20.

where Q is the number of books sold (in thousands) and P is the book price. Given the availability of this book on amazon.com for $20, demand is perfectly elastic at a price of $20.

Correct Answer:

Verified

Q22: Franchise Tax and Inelastic Demand. Assume the

Q23: Percentage Tariff and Elastic Demand. Assume that

Q24: Percentage Tax and Inelastic Demand. Assume the

Q25: Competitive Market Equilibrium. Assume demand and supply

Q26: Above-normal returns earned in the time interval

Q28: Franchise Tax and Inelastic Demand. Assume the

Q29: Competitive Market Surplus. Suppose demand and supply

Q30: A price floor is a costly and

Q31: The costs of pollution taxes are shared

Q32: Competitive Market Equilibrium. Suppose demand and supply

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents