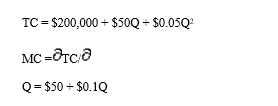

Compulsory Benefit Costs. Columbia Federal Savings & Loan, Inc. offers low-cost home mortgage refinancing services on the Internet. Each refinancing brings the company $250 in fees, and these fees are stable given the competitive nature of Internet marketing. Columbia's relies upon independent contractors (sales associates) who work on a commission-only basis. Weekly total cost (TC) and marginal cost (MC) relations are:

where Q is thousands of refinancing applications processed.

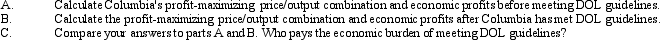

Suppose the US Department of Labor recently ruled that Columbia's sales associates must be considered employees entitled to benefits under the Employee Retirement Income Security Act (ERISA). As a result, Columbia's marginal cost of doing business will rise by $25 per unit. Columbia's fixed expenses, which include a required return on investment, will be unaffected.

Correct Answer:

Verified

Q29: Competitive Market Surplus. Suppose demand and supply

Q30: A price floor is a costly and

Q31: The costs of pollution taxes are shared

Q32: Competitive Market Equilibrium. Suppose demand and supply

Q33: Economic rents are profits due to:

A) luck.

B)

Q35: Competitive Market Surplus. Assume demand and supply

Q36: Regulation Costs. Kingston Components, Inc., produces electronic

Q37: Recycling Fee and Elastic Demand. Assume that

Q38: Franchise Tax and Inelastic Demand. Assume the

Q39: A price ceiling is a costly and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents