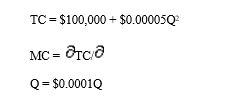

Tariffs. The Manchester Shoe Corporation is an importer and distributor of foreign-made footwear that is sold at popular prices in leading discount retailers. The U.S. Commerce Department recently informed the company that it will be subject to a new 25% tariff on the import cost of rubberized footwear originating from China. The company is concerned that the tariff will slow its sales growth, given the highly competitive nature of the footwear market where wholesale prices are stable at $5 per unit. Relevant total cost (TC) and marginal cost (MC) relations for this product are:

Correct Answer:

Verified

Q40: Social Welfare Concepts. Indicate whether each of

Q41: Competitive Strategy. Bob Ice owns and operates

Q42: Compulsory Benefit Costs. The Telemarketing Louisianan Company

Q43: Costs of Regulation. The Appalachian Coal Company

Q44: Outsourcing Tariffs. The Seattle Software Company develops,

Q45: Regulation Costs. Finlandia, Inc., manufacturers molded plastic

Q46: Regulation Costs. Ottawa Construction, Ltd., is a

Q47: Price Floors and Consumer Surplus. The U.

Q48: Competitive Strategy. Carry Underwood runs Tax Preparation

Q49: Price Floors and Producer Surplus. The U.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents