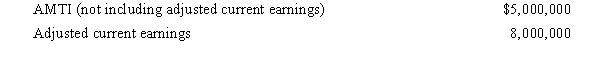

During 2008,Brown Corporation (a calendar year taxpayer) has $4,000,000 of taxable income and the following transactions:

Brown Corporation's alternative minimum tax (AMT) for 2008 is:

A) $90,000.

B) $500,000.

C) $700,000.

D) $1,360,000.

E) None of the above.

Correct Answer:

Verified

Q53: In 2008,Jay Corporation (a calendar year taxpayer)had

Q54: Boat Corporation manufactures an exercise machine at

Q55: If a corporation's income is solely from

Q57: Bacon Corporation manufactures an exercise machine at

Q59: For purposes of the penalty tax on

Q60: Which of the following items will be

Q63: Maize Corporation has average gross receipts of

Q88: Swan Corporation has gross receipts of $3

Q97: Which entity is subject to the ACE

Q104: Why is the DPAD benefit somewhat unique?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents