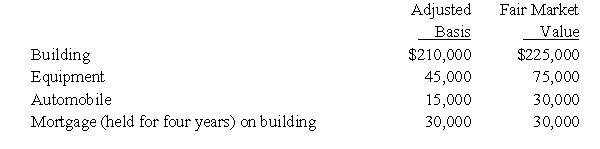

Rick transferred the following assets and liabilities to Warbler Corporation.

In return Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding (fair market value of $225,000) .

A) Rick has a recognized gain of $60,000.

B) Rick has a recognized gain of $75,000.

C) Rick's basis in the stock of Warbler Corporation is $270,000.

D) Warbler Corporation has the same basis in the assets received as Rick does in the stock.

E) None of the above.

Correct Answer:

Verified

Q49: Ann transferred land worth $200,000, with a

Q53: Three individuals form Skylark Corporation with the

Q56: Paul,a cash basis taxpayer,incorporates his sole proprietorship.He

Q56: Amy owns 20% of the stock of

Q61: Shawn,a sole proprietor,is engaged in a service

Q63: Four individuals form Chickadee Corporation under §

Q65: Kirby and Helen form Red Corporation.Kirby transfers

Q87: When Pheasant Corporation was formed under §

Q94: Ashley, a 70% shareholder of Wren Corporation,

Q100: Eve transfers property (basis of $120,000 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents