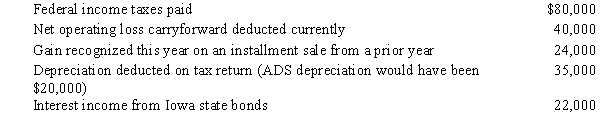

Emu Corporation (a calendar year taxpayer) has taxable income of $250,000,and its financial records reflect the following for the year.

Emu Corporation's current E & P is:

A) $149,000.

B) $193,000.

C) $223,000.

D) $271,000.

E) None of the above.

Correct Answer:

Verified

Q28: If stock rights are taxable, the recipient

Q30: Pink,Corporation,a calendar year taxpayer,made quarterly estimated tax

Q33: During the current year,Blue Corporation sold equipment

Q33: Property distributed by a corporation as a

Q36: A corporate shareholder that receives a constructive

Q38: The rules used to determine the taxability

Q38: Jen,the sole shareholder of Mahogany Corporation,sold her

Q39: Under no circumstances can a distribution generate

Q40: Scarlet Corporation has a deficit in accumulated

Q51: Tern Corporation, a cash basis taxpayer, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents