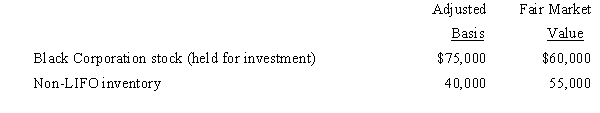

In the current year,Verdigris Corporation (with E & P of $250,000) made the following property distributions to its shareholders (all corporations) :

Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

A) The shareholders have dividend income of $100,000.

B) The shareholders have dividend income of $130,000.

C) Verdigris has a gain of $15,000 and a loss of $15,000, both of which it must recognize.

D) Verdigris has no recognized gain or loss.

E) None of the above.

Correct Answer:

Verified

Q55: Puffin Corporation has E & P of

Q56: Green Corporation has accumulated E & P

Q57: Rust Corporation has accumulated E & P

Q59: On January 1,Tanager Corporation (a calendar year

Q61: Jose receives a nontaxable distribution of stock

Q62: Using the legend provided, classify each statement

Q65: Using the legend provided, classify each statement

Q123: Using the legend provided, classify each statement

Q129: Using the legend provided, classify each statement

Q134: Rosie,the sole shareholder of Eagle Corporation,has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents