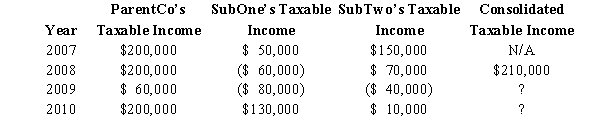

ParentCo,SubOne and SubTwo have filed consolidated returns since 2008.All of the entities were incorporated in 2007.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.

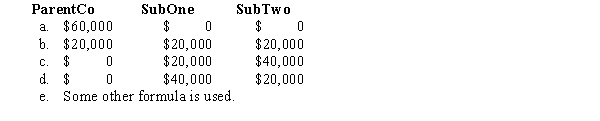

How should the 2009 consolidated net operating loss be apportioned among the group members?

Correct Answer:

Verified

Q47: ParentCo purchased all of SubCo's stock on

Q48: ParentCo acquired all of the stock of

Q49: Which of the following is eligible to

Q50: The Rub,Sal,and Ton Corporations file Federal income

Q51: The consolidated group reported the following taxable

Q53: The consolidated group reported the following taxable

Q54: ParentCo and SubCo have filed consolidated returns

Q55: The consolidated group reported the following taxable

Q56: Conformity among the members of a consolidated

Q57: ParentCo purchased all of the stock of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents