Parent Corporation's current-year taxable income included $100,000 net income from operations and a $40,000 net long-term capital gain.Parent also made a $19,000 contribution to State University.SubCo produced $75,000 income from operations and incurred a $50,000 net short-term capital loss.

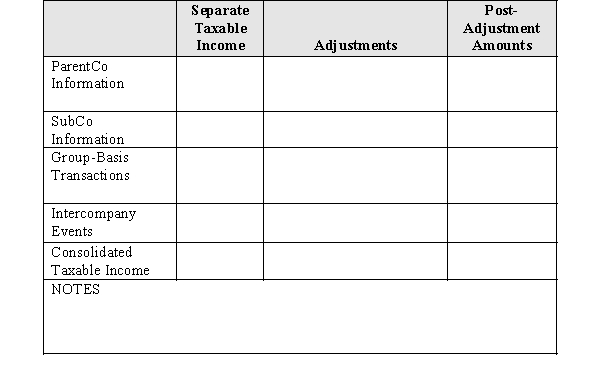

Use the computational worksheet of Figure 8-2 to derive the group members' separate taxable incomes and the group's consolidated taxable income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: Where are the controlling Federal income tax

Q127: Parent Corporation,SubOne,and SubTwo have filed consolidated returns

Q128: Why do separate corporations form conglomerates,such that

Q129: List the filing requirements that must be

Q130: LargeCo files on a consolidated basis with

Q131: The group of Parent Corporation,SubOne,and SubTwo has

Q131: How many consolidated tax returns are filed

Q133: Calendar year Parent Corporation acquired all of

Q133: Outline the major advantages and disadvantages of

Q142: Discuss how a parent corporation computes its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents