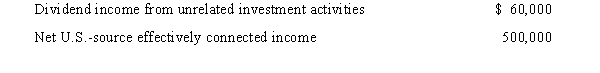

BrazilCo,Inc.,a foreign corporation with a U.S.trade or business,has U.S.-source income as follows.

Determine BrazilCo's total U.S.tax liability for the year assuming a 35% corporate rate and no tax treaty.Assume BrazilCo leaves its U.S.branch profits invested in the United States and does not otherwise repatriate any of its U.S.assets during the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q108: Match the definition with the correct term.

-Activity

Q113: Match the definition with the correct term.

-A

Q114: Match the definition with the correct term.

-Individual

Q116: Match the definition with the correct term.

-Income

Q117: Match the definition with the correct term.

Q117: Wallack,Inc.,a U.S.corporation,owns 100% of Orion,Ltd.,a foreign corporation.Orion

Q119: Match the definition with the correct term.

a.Foreign

Q120: Match the definition with the correct term.

a.Indirect

Q126: BendCo,Inc.,a U.S.corporation,has foreign-source income and pays foreign

Q158: Arendt, Inc., a domestic corporation, purchases a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents