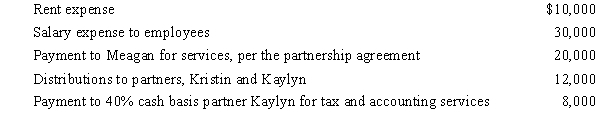

Meagan is a 40% general partner in the calendar year,cash basis MKK Partnership.The partnership received $100,000 income from services and paid the following other amounts:

How much is Meagan's adjusted gross income increased as a result of the above items?

A) $8,000.

B) $12,800.

C) $32,000.

D) $32,800.

E) $40,800.

Correct Answer:

Verified

Q24: Cheryl and Nina formed a partnership.Cheryl received

Q26: Alicia and Barry form the AB Partnership

Q27: Jim and Marta created the JM Partnership

Q33: Sharon and Sara are equal partners in

Q34: In the current year,the DOE Partnership received

Q53: Partner Tom transferred property (basis of $20,000;

Q64: Tina and Randy formed the TR Partnership

Q82: Richard made a contribution of property to

Q85: At the beginning of the tax year,Wick's

Q88: Fern,Inc. ,Ivy Inc. ,and Jason formed a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents