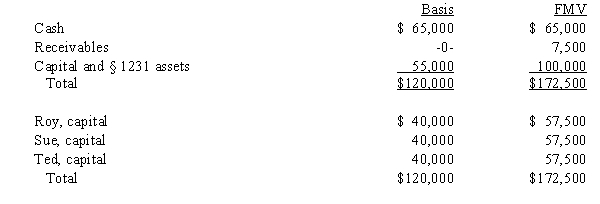

The December 31,2008,balance sheet of the RST General Partnership reads as follows.

The partners share equally in partnership capital,income,gain,loss,deduction and credit.Ted's adjusted basis for his partnership interest is $40,000.On December 31,2008,he retires from the partnership,receiving a $60,000 cash payment in liquidation of his interest.The partnership agreement states that $2,500 of the payment is for goodwill.Which of the following statements about this distribution is false?

A) If capital is NOT a material income-producing factor to the partnership, the § 736(a) payment will be $2,500.

B) If capital IS a material income-producing factor, the entire $60,000 payment will be a § 736(b) property payment.

C) The payment for Ted's share of goodwill will create $2,500 of ordinary income to him.

D) The partnership can deduct any amount which is a § 736(a) payment since it will be determined without regard to partnership profits.

E) All statements are false.

Correct Answer:

Verified

Q21: James received $42,000 cash and a capital

Q22: Toni's basis in her partnership interest was

Q23: Barney,Bob,and Billie are equal partners in the

Q28: On December 31 of last year,Pat gave

Q49: The LMO Partnership distributed $30,000 cash to

Q63: Carlos receives a proportionate liquidating distribution consisting

Q68: Which of the following transactions will not

Q72: A partnership may make an optional election

Q110: Marty receives a proportionate nonliquidating distribution when

Q136: Which of the following statements about the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents