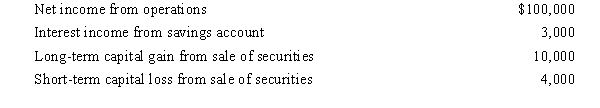

During 2008,Lion Corporation incurs the following transactions.

Lion maintains a valid S election and does not distribute any dividends to its sole shareholder,Penny.As a result,Penny must recognize:

A) Ordinary income of $103,000 and long-term capital gain of $5,000.

B) Ordinary income of $103,000, long-term capital gain of $10,000, and $4,000 short-term capital loss.

C) Ordinary income of $108,000.

D) None of the above.

Correct Answer:

Verified

Q68: Which transaction affects the Other Adjustments Account

Q71: Which statement is incorrect with respect to

Q78: During 2008,Houston Nutt,the sole shareholder of a

Q81: On January 2,2007,David loans his S corporation

Q85: A calendar year C corporation has a

Q86: Lott Corporation in Macon,Georgia converts to S

Q87: An S corporation in Lawrence,Kansas has a

Q88: During 2008,an S corporation in Gainesville,Florida,incurs the

Q95: Fred is the sole shareholder of an

Q98: On January 1,Bobby and Alice own equally

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents