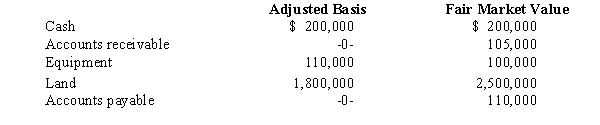

Apple,Inc.,a cash basis S corporation in Orange,Texas,formerly was a C corporation.Apple has the following assets and liabilities on January 1,2008,the date the S election is made.

During 2008,Apple collects the accounts receivable and pays the accounts payable.The land is sold for $3 million,and taxable income for the year is $590,000.What is Apple's built-in gains tax?

A) $0.

B) $206,500.

C) $590,000.

D) $695,000.

E) Some other amount.

Correct Answer:

Verified

Q85: A calendar year C corporation has a

Q86: Lott Corporation in Macon,Georgia converts to S

Q87: An S corporation in Lawrence,Kansas has a

Q88: During 2008,an S corporation in Gainesville,Florida,incurs the

Q90: A cash basis calendar year C corporation

Q91: On January 2,2007,David loans his S corporation

Q91: A C corporation elects S status.The corporation

Q93: You are given the following facts about

Q94: You are given the following facts about

Q95: Fred is the sole shareholder of an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents