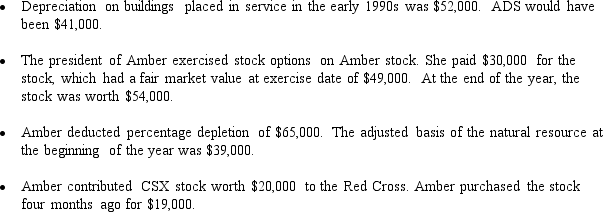

Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.

What is Amber's AMTI?

A) $212,000.

B) $233,000.

C) $238,000.

D) $249,000.

E) None of the above

Correct Answer:

Verified

Q45: Corporate profits have no effect on a

Q47: Carol is a 60% owner of a

Q48: To the extent of built-in gain at

Q49: The special allocation opportunities that are available

Q51: From the perspective of the buyer of

Q52: While the S corporation generally is a

Q52: If an individual contributes an appreciated personal

Q54: Amos contributes land with an adjusted basis

Q58: Mercedes owns a 40% interest in Teal

Q79: Aaron purchases a building for $500,000 which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents