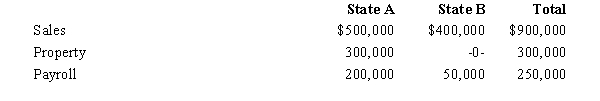

-Dott Corporation generated $300,000 of state taxable income from selling its mapping software in States A and B.For the taxable year,the corporation's activities within the two states were as follows.

Dott has determined that it is subject to tax in both A and B.Both states utilize a three-factor apportionment formula equally weights sales,property,and payroll.The rates of corporate income tax imposed in A and B are 10% and 6%,respectively.Determine Dott's state income tax liability.

Correct Answer:

Verified

Q97: The sale of a used auto probably

Q152: Compute Quail Corporation's State Q taxable income

Q153: Node Corporation is subject to tax only

Q155: Milt Corporation owns and operates two facilities

Q156: Provide the required information for Wren Corporation,whose

Q158: Troy,an S corporation,is subject to tax only

Q159: Kim Corporation,a calendar year taxpayer,has manufacturing facilities

Q160: Shaker Corporation operates in two states,as indicated

Q161: Why is a knowledge of Federal income

Q162: Why does the advent of telecommuting present

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents