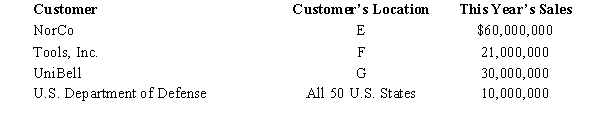

State E applies a throwback rule to sales,while State F does not.State G has not adopted an income tax to date.Mercy Corporation,headquartered in F,reported the following sales for the year.All of the goods were shipped from Mercy's F manufacturing facilities.Mercy's degree of operations is sufficient to establish nexus only in E and F.Determine its sales factor in those states.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: A _ tax is designed to complement

Q139: Leased property,when included in the property factor,usually

Q140: The tax usually is applied at the

Q140: Several states allow the S corporation to

Q141: You are completing the State A income

Q143: Pail Corporation is a merchandiser.It purchases overstock

Q145: Indicate for each transaction whether a sales

Q146: Garcia Corporation is subject to tax in

Q148: Condor Corporation generated $450,000 of state taxable

Q149: Almost all of the states tax a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents