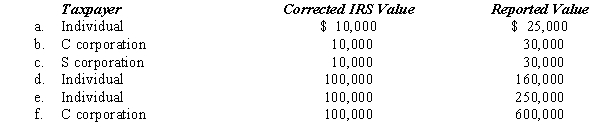

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal income tax rate of 30%.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: A penalty for understating a tax liability

Q106: A negligence penalty can be waived if

Q111: Why should the tax practitioner study the

Q118: An individual is not subject to penalty

Q119: The taxpayer can use a(n)_ _ without

Q121: Dana underpaid his taxes by $170,000.Portions of

Q124: According to AICPA rules,a tax preparer must

Q125: Carol's AGI last year was $180,000.Her Federal

Q127: Rhoda,a calendar year individual taxpayer,files her 2006

Q131: How do rulings issued by the IRS

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents