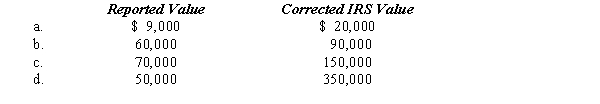

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal estate tax rate of 45%.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: List several current initiatives that the IRS

Q111: Why should the tax practitioner study the

Q124: According to AICPA rules,a tax preparer must

Q125: Carol's AGI last year was $180,000.Her Federal

Q127: Rhoda,a calendar year individual taxpayer,files her 2006

Q130: Kim underpaid her taxes by $30,000.Of this

Q131: How do rulings issued by the IRS

Q131: Compute the failure to pay and failure

Q132: The Square Services Corporation estimates that its

Q133: Orville,a cash basis,calendar year taxpayer,filed his income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents