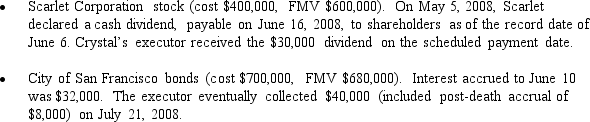

At the time of her death on June 10,2008,Crystal owned the following assets.

As to these transactions,how much is included in Crystal's gross estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Classify each statement appropriately.

-Mortgage on land included

Q124: Classify each of the following independent statements:.

-Proceeds

Q128: Classify each statement appropriately.

-State death tax imposed

Q159: Classify each of the independent statements appearing

Q161: Michael and Addison are married and have

Q165: Classify each of the independent statements appearing

Q166: At the time of her death,Patricia was

Q189: Classify each statement appearing below.

a. No taxable

Q201: Classify each statement appropriately.

a.Deductible from the gross

Q207: Classify each statement appropriately.

a.Deductible from the gross

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents