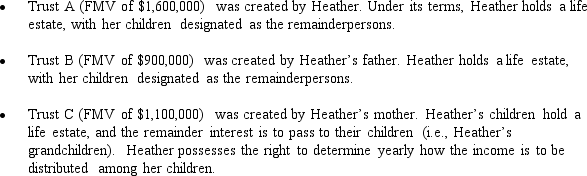

At the time of her death,Heather was involved in three trust arrangements.Details regarding these trusts are summarized below.

As to these trusts,how much will be included in Heather's gross estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Classify each statement appropriately.

-Casualty loss to property

Q132: Classify each statement appropriately.

-State income taxes accrued

Q134: Classify each statement appropriately.

-Casualty loss to property

Q135: Classify each statement appropriately.

-Selling expenses incurred to

Q176: Prior to his death in 2008,Cameron made

Q179: At the time of his death on

Q180: Alvin and Lindsay are husband and wife

Q181: Classify each statement appropriately.

a.Deductible from the gross

Q204: Classify each statement appropriately.

a.Deductible from the gross

Q208: Classify each statement appropriately.

a.Deductible from the gross

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents