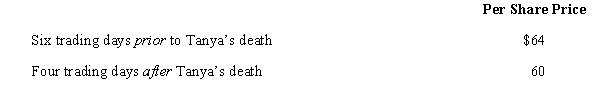

At the time of her death,Tanya owned stock in Petrel Corporation.The stock is traded on a local exchange with the most recent selling prices as follows.

Presuming no alternate valuation date election,Tanya's gross estate should include a per share value of

A) $24.00.

B) $38.00.

C) $61.60.

D) $62.40.

E) None of the above.

Correct Answer:

Verified

Q43: For the IRS to grant a discretionary

Q55: Harvey owns a certificate of deposit listed

Q56: If § 6166 applies,a 2% rate of

Q58: In a husband/wife setting,good tax planning dictates

Q59: The deferral approach to the estate tax

Q61: Which,if any,are characteristics of the valuation tables

Q62: Lesley and Morgan are husband and wife

Q63: Which,if any,of the following statements properly characterize

Q64: In 1985,Justin,a resident of New York,purchases realty

Q65: In January 2008,Sid makes a gift of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents