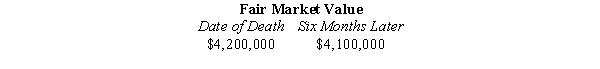

Art and Melinda have always lived in a community property state.At the time of Art's prior death,they held land that cost them $500,000 but was valued as follows.

Under Art's will,his half of the land passes to their daughter,Matilda.What income tax basis will Melinda and Matilda have in the land,if Art's estate:

a.Elects the alternate valuation date of § 2032?

b.Does not elect the alternate valuation date of § 2032?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: Mel's estate includes a number of notes

Q151: Brandi is the founder of Carmine Corporation

Q152: Harry and Dolores are married and live

Q153: What is the justification,if any,for allowing a

Q154: In connection with a traditional IRA that

Q157: Merwyn makes a gift of securities (basis

Q158: In March 2007,Tyrone gives his mother,Grace,real estate

Q159: At the time of her death,Lila owns

Q160: In February 2007,Michelle sold real estate (adjusted

Q161: In terms of future estate tax (and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents