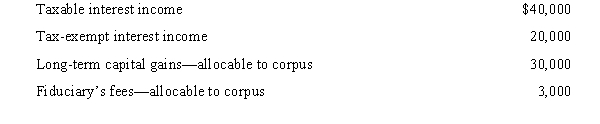

The trustee of the Miguel Trust can distribute any amount of accounting income and corpus to the trust's income beneficiaries,Paula and George.This year,the trust incurred the following.

The trustee distributed $40,000 to Paula and $40,000 to George.

a.What is Miguel's trust accounting income?

b.What is Miguel's DNI?

c.What is Miguel's taxable income?

d.How much gross income is recognized by each of the beneficiaries?

Correct Answer:

Verified

b.$57,000.

c.$29,900.

d.$19,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: What is a simple trust? A complex

Q109: Identify the parties that are present when

Q114: How does the alternative minimum tax affect

Q121: Describe how an estate or trust treats

Q132: Can a trust or estate claim a

Q140: The Circle Trust has some exempt interest

Q145: What is meant by the term "distributable

Q145: List several key planning ideas with respect

Q146: What factors should be considered in choosing

Q150: How is entity accounting income computed? What

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents