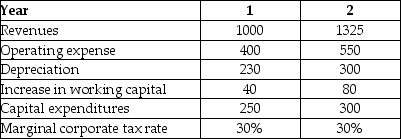

Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the following cash flows for the first two years (in millions of dollars) .  The depreciation tax shield for Shepard Industries project in year 2 is closest to ________.

The depreciation tax shield for Shepard Industries project in year 2 is closest to ________.

A) $90 million

B) $69 million

C) $135 million

D) $108 million

Correct Answer:

Verified

Q44: Q45: Your firm is considering building a new Q48: Shepard Industries is evaluating a proposal to Q48: A firm is considering changing their credit Q51: Epiphany Industries is considering a new capital Q52: The Sisyphean Company is considering a new![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents