Multiple Choice

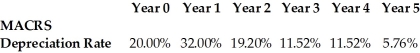

A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A) $11,520

B) $9480

C) $3792

D) $17,208

Correct Answer:

Verified

Related Questions

Q29: Which of the following is an example

Q61: An announcement by the government that they

Q65: Firms should use the most accelerated depreciation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents