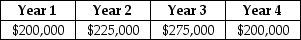

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $420,000. The Sisyphean Company expects cash inflows from this project as detailed below:  The appropriate discount rate for this project is 16%. The net present value (NPV) for this project is closest to ________.

The appropriate discount rate for this project is 16%. The net present value (NPV) for this project is closest to ________.

A) $206,265

B) $144,385

C) $515,661

D) $216,578

Correct Answer:

Verified

Q25: Under what situation can the net present

Q27: Which of the following situations can lead

Q28: Which of the following statements is FALSE?

A)

Q32: What is the general shape of the

Q32: Consider the following two projects:

Q33: The internal rate of return (IRR) rule

Q33: A bakery is deciding whether to buy

Q37: Use the information for the question(s) below.

Q45: Which of the following is NOT a

Q56: According to Graham and Harvey's 2001 survey

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents