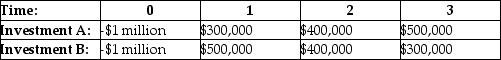

An investor is considering the two investments shown above. Her cost of capital is 8%. Which of the following statements about these investments is true?

An investor is considering the two investments shown above. Her cost of capital is 8%. Which of the following statements about these investments is true?

A) The investor should take investment A since it has a greater net present value (NPV) .

B) The investor should take investment A since it has a greater internal rate of return (IRR) .

C) The investor should take investment B since it has a greater net present value (NPV) .

D) The investor should take investment B since it has a greater internal rate of return (IRR) .

Correct Answer:

Verified

Q64: When comparing mutually exclusive projects which have

Q66: Internal rate of return (IRR) can reliably

Q70: Q73: The cash flows for four investments have Q74: Two mutually exclusive investment opportunities require an Q75: The following show four mutually exclusive investments. Q76: Consider the following two projects: Q78: Consider the following two projects: Q79: The cash flows for four projects are Q87: Is there a unique way for calculating![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents