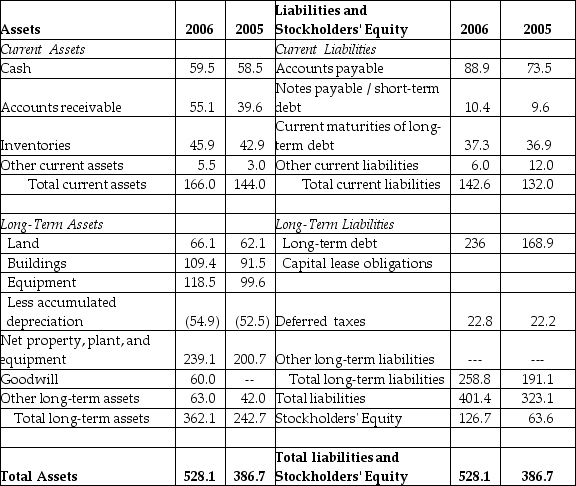

Luther Corporation Consolidated Balance Sheet

December 31, 2006 and 2005 (in $ millions)  Refer to the balance sheet above. If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then Luther's market-to-book ratio would be closest to ________.

Refer to the balance sheet above. If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then Luther's market-to-book ratio would be closest to ________.

A) 2.58

B) 0.64

C) 1.29

D) 1.80

Correct Answer:

Verified

Q3: Stockholders' equity is the difference between a

Q6: International Financial Reporting Standards are taking root

Q13: Financial statements are optional accounting reports issued

Q18: In the United States, publicly traded companies

Q21: Luther Corporation Consolidated Balance Sheet

December 31, 2006

Q23: The major components of stockholders' equity are

Q24: Luther Corporation Consolidated Balance Sheet

December 31, 2006

Q48: In general, a successful firm will have

Q66: A public company has a book value

Q71: A company has a share price of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents