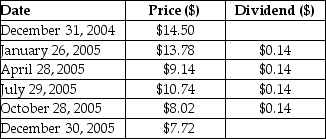

Consider the following price and dividend data for Quicksilver Inc.:  Assume that you purchased Quicksilver's stock at the closing price on December 31, 2004 and sold it after the dividend had been paid at the closing price on January 26, 2005. Your total return rate (yield) for this period is closest to ________.

Assume that you purchased Quicksilver's stock at the closing price on December 31, 2004 and sold it after the dividend had been paid at the closing price on January 26, 2005. Your total return rate (yield) for this period is closest to ________.

A) 0.97%

B) -4.00%

C) -4.97%

D) 1.06%

Correct Answer:

Verified

Q41: The Ishares Bond Index fund (TLT) has

Q48: The average annual return over the period

Q51: McCoy paid a one-time special dividend of

Q53: If a stock pays dividends at the

Q56: Consider the following price and dividend data

Q57: Which type of investment has historically had

Q59: What are the two components of realized

Q59: Consider the following price and dividend data

Q62: Consider the following average annual returns:

Q65: There is an overall relationship between _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents