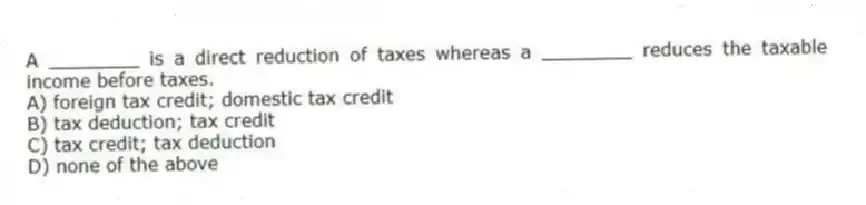

A ________ is a direct reduction of taxes whereas a ________ reduces the taxable income before taxes.

A) foreign tax credit; domestic tax credit

B) tax deduction; tax credit

C) tax credit; tax deduction

D) none of the above

Correct Answer:

Verified

Q17: The United States taxes the domestic and

Q19: Tax treaties typically result in _ between

Q20: A tax that is a form of

Q21: Explain the worldwide and territorial approaches of

Q23: TABLE 15.1

Use the information to answer following

Q24: What is a value-added tax? Where is

Q25: TABLE 15.1

Use the information to answer following

Q26: Between 2006-2012, global corporate tax rates have

Q27: FEW governments rely on income taxes, both

Q80: The primary objective of multinational tax planning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents