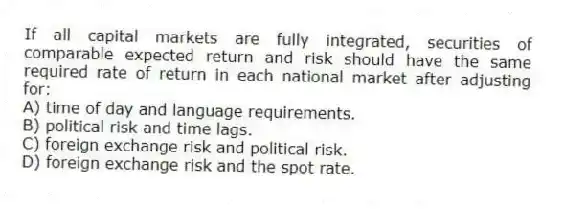

If all capital markets are fully integrated, securities of comparable expected return and risk should have the same required rate of return in each national market after adjusting for:

A) time of day and language requirements.

B) political risk and time lags.

C) foreign exchange risk and political risk.

D) foreign exchange risk and the spot rate.

Correct Answer:

Verified

Q46: The primary goal of both domestic and

Q47: International diversification benefits may induce investors to

Q48: Use of the International CAPM (ICAPM) assures

Q49: A global portfolio is an index of

Q50: Capital market imperfections leading to financial market

Q52: Capital market imperfections leading to financial market

Q53: International CAPM (ICAPM) assumes that there is

Q54: The authors refer to companies that have

Q55: Increasing the number of securities in a

Q56: If the addition of a foreign security

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents