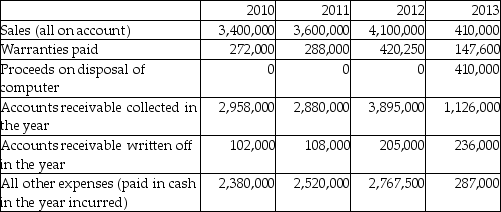

Xavier Computer Limited was started in early 2010 and continued to operate until early 2013, when it was wound up due to disputes between the two principal shareholders. When it started, the company used the following accounting policies:

1. Use 50% declining-balance depreciation for the firm's only asset, a computer which cost $1,100,000 and has an estimated useful life of four years.

2. Estimate warranty expense as 10% of sales.

3. The year-end allowance for doubtful accounts should be 40% of gross accounts receivable.

Derive net income for 2010 to 2012. For the year-end balance for 2013, assume accounts receivable, allowance for doubtful accounts, and the warranty accrual are $0, as the firm wound itself up during the year and all timing differences have been resolved.

Correct Answer:

Verified

Q21: Explain what is meant by "quality of

Q22: What is meant by "earnings quality"?

A)A measure

Q29: What are excessive accruals?

A)Accruals that are based

Q32: A company's reported earnings are $2,000 and

Q34: Which statement correctly explains the relationship between

Q42: Computer Consulting Limited was started in early

Q44: Computer Consulting Limited was started in early

Q45: Sing Songs Ltd. started operations on January

Q46: Sing Songs Ltd. started operations on January

Q51: The following event occurred after the company's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents