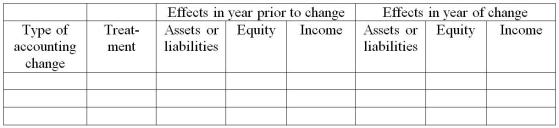

For each of the following scenarios, determine the effects (if any)of the accounting change (correction of error, change in accounting policy, or change in estimate)on the relevant asset or liability, equity, and comprehensive income in the year of change and the prior year. Use the following table for your response.  A. Company A increases the allowance for doubtful accounts (ADA). Using the old estimate, ADA would have been $71,000. The new estimate is $74,000.

A. Company A increases the allowance for doubtful accounts (ADA). Using the old estimate, ADA would have been $71,000. The new estimate is $74,000.

B. Company B omitted to record an invoice for a $7,000 sale made on credit at the end of the previous year and incorrectly recorded the sale in the current year. The related inventory sold has been accounted for.

C. Company C changes its revenue recognition policy to a more conservative one. The result is a decrease in prior year revenue of $4,200 and a decrease in current-year revenue of $6,300 relative to the amounts under the old policy.

Correct Answer:

Verified

Q83: Which of the following would be accounted

Q85: Explain why a change in accounting policy

Q88: Which of the following would be accounted

Q91: Which of the following would be accounted

Q92: For the following types of accounting changes,

Q93: Which of the following would be accounted

Q97: What is the effect of overstating 2012

Q98: The method of depreciation was changed from

Q99: Explain how changes in accounting policies, changes

Q114: Which asset groups do not need to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents