Hatcher Limited, a private company, was started on January 1, 2011. For the first year, the chief accountant prepared the financial statements and a local accountant completed the necessary review of these statements. However, for the year ended December 31, 2012, an external auditor was appointed. For each situation below, explain the recommended treatment for each of these matters in terms of whether they are errors, changes in accounting policy, or changes in estimate. Explain your conclusion.

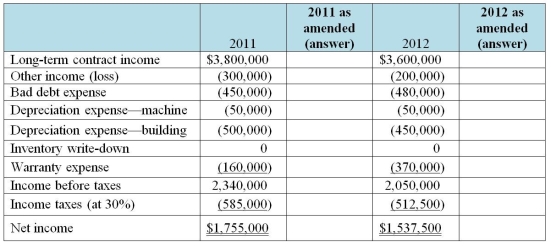

1)Long-term contracts: Hatcher used the completed contract method for revenue recognition in 2011. Management now believes that the percentage of completion method would be better. Income under the completed contract method for 2011 was $3,800,000 and for 2012 it was $3,600,000. If the percentage of completion method had been used, the incomes would have been $5,800,000 (2011)and $3,400,000 (2012).

2)Accounts receivable: The accounts receivable on December 31, 2011, included a $30,000 account which was not provided for but subsequently was written off during 2012 as the customer went bankrupt after the issuance of the financial statements. Hatcher would like to adjust 2011 for this oversight as it sees this as an error.

3)Machine depreciation: Hatcher has a machine that cost $500,000 and has been depreciated over an estimated useful life of 10 years. Upon reviewing the manufacturer's reports in 2012, management now firmly believes the machine will last a total of 15 years from date of purchase. They would like to change last year's depreciation charge based on this analysis. Depreciation expense of $50,000 has been recorded for 2012.

4)Building depreciation: The company's building (cost $5,000,000, estimated salvage value $0, useful life 20 years)was depreciated last year using the 10% declining-balance method. The company and auditor now agree that the straight-line method would be a more appropriate method to use. A depreciation provision of $450,000 has been made for 2012.

5)Inventories: The accountant last year failed to apply the lower of cost or net realizable value to ending inventory. Upon review, the inventory balance for last year should have been reduced by $250,000. The closing inventory allowance for this year-end should be $370,000. No entry has been made for this.

6)Warranties: Hatcher does not accrue for warranties; rather it records the warranty expense when amounts are paid. Hatcher provides a one-year warranty for defective goods. Payments to satisfy warranty claims in 2011 were $160,000, and $370,000 in 2012. Out of the $370,000 paid in 2012, $170,000 related to 2011 sales. A reasonable estimate of warranties payable at the end of 2012 is $270,000.

Correct Answer:

Verified

Q83: Which of the following would be accounted

Q91: Which of the following would be accounted

Q98: The method of depreciation was changed from

Q104: What is classified as a "non-current" liability?

A)An

Q106: What is classified as a "non-current" liability?

A)An

Q109: Which statement is not correct?

A)The balance sheet

Q111: Which statement is correct about expenses in

Q112: Which statement is not correct about expenses

Q114: Which asset groups do not need to

Q118: Expenses in the income statement may

A)be classified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents